A Small Business Restructure could be the lifeline your business needs.

A Small Business Restructure could be the lifeline your business needs.

Apply for a Small Business Restructure Plan and get your business back on track in just 35 business days^

^35 business days is the government dictated timeline, starting from the date of submission. Pre-submission discovery and discussions are not covered by and may cause the process to exceed stated timeline. *All figures and averages are based off SBR Specialists actual totals and are correct at time of distribution. All numbers are indicative and actual results will vary. SBR Specialists make or imply no guarantee regarding future outcomes.

Apply for a Small Business Restructure Plan and get your business back on

track in just 35 business days^

^35 business days is the government dictated timeline, starting from the date of submission. Pre-submission discovery and discussions are not covered by and may cause the process to exceed stated timeline. *All figures and averages are based off SBR Specialists actual totals and are correct at time of distribution. All numbers are indicative and actual results will vary. SBR Specialists make or imply no guarantee regarding future outcomes.

What is Small Business Restructuring?

A Small Business Restructure is an ATO-led initiative that allows businesses to reduce debts and create a roadmap back to success in only 35 business days.

The Small Business Restructure Process (SBRP) is a government- legislated option for small businesses in Australia that are struggling with cash flow.

It allows business owners to appoint a Small Business Restructuring Practitioner to develop a restructuring plan approved by the ATO and other creditors.

The plan involves debt reduction and other other measures so you can get your business back on track and keep trading.

Small Business Restructuring Benefits

What is Small Business Restructuring?

A Small Business Restructure is an ATO-led initiative that allows businesses to reduce debts and create a roadmap back to success in only 35 business days.

The Small Business Restructure Process (SBRP) is a government- legislated option for small businesses in Australia that are struggling with cash flow.

It allows business owners to appoint a Small Business Restructuring Practitioner to develop a restructuring plan approved by the ATO and other creditors.

The plan involves debt reduction and other other measures so you can get your business back on track and keep trading.

The Benefits

restructure is being finalised

schedules

back to running the business

How Does The Restructuring Process Work?

1. Eligibility

Complete the 1-minute form to see if your business meets the minimum requirements to qualify for a restructure.

2. Consultation

A specialist contacts you to determine if restructuring is viable and suitable for you and your business.

3. Due Diligence

We determine your financial position: accounts, income, liabilities, financial debts and creditors.

4. Appointment

If you qualify and are happy to proceed, you appoint us as your restructuring practitioner. Fees are placed in a trust fund

5. Restructuring

Once appointed, we begin the restructuring process.

How Does The Restructuring Process Work?

1. Eligibility

Complete the 1-minute form to see if your business meets the minimum requirements to qualify for a restructure.

2. Consultation

A specialist contacts you to determine if restructuring is viable and suitable for you and your business.

3. Due Diligence

We determine your financial position: accounts, income, liabilities, financial debts and creditors.

4. Appointment

If you qualify and are happy to proceed, you appoint us as your restructuring practitioner. Fees are placed in a trust fund

5. Restructuring

Once appointed, we begin the restructuring process.

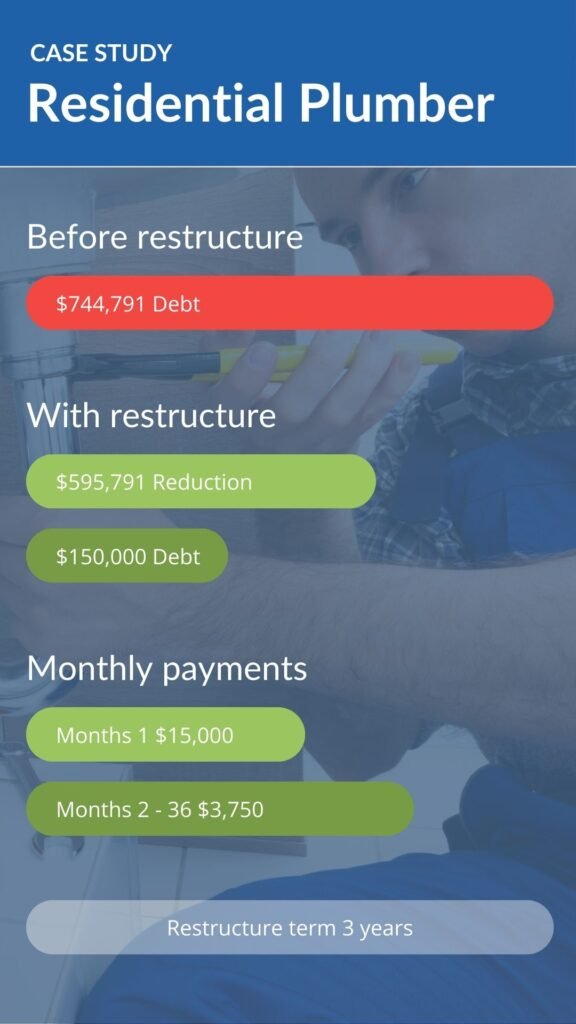

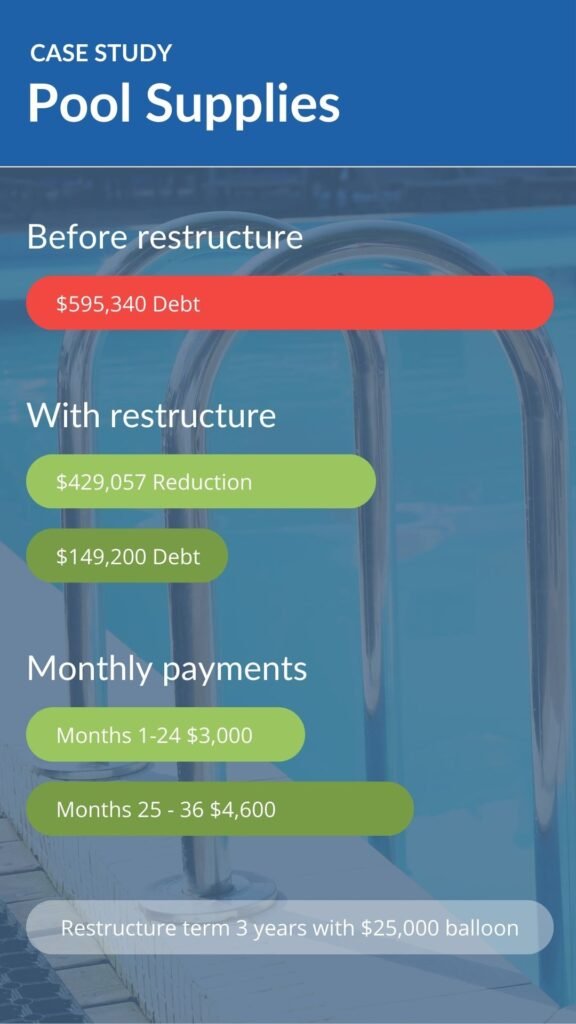

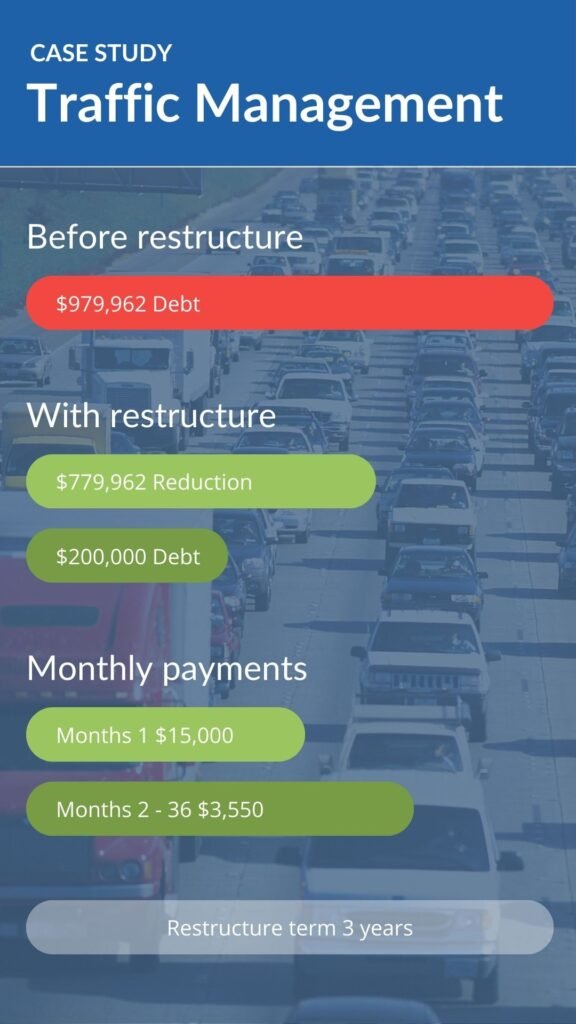

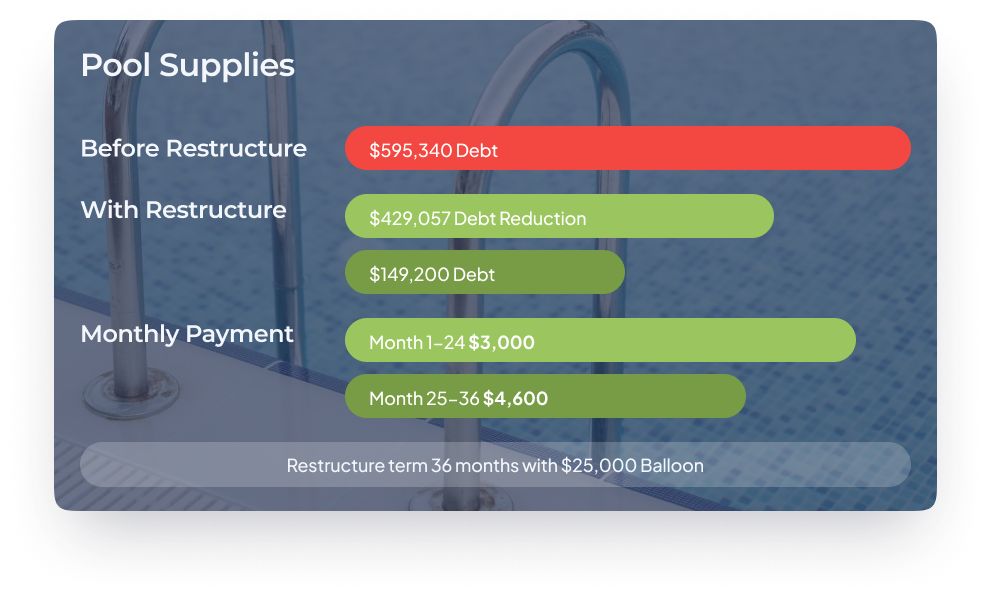

Case Studies

We have a 95% success rate with achieving 80%+ simplified debt reduction

Case Studies

We have a 95% success rate with achieving 80%+ simplified debt reduction

Ready To Get Your Business Back On Track?

Check if your company is eligible for restructuring in 60 seconds.

All inquiries are confidential.

Ready To Get Your Business Back On Track?

Check if your company is eligible for restructuring in 60 seconds.

All inquiries are confidential.

Testimonials

[sbr-testimonial]

Commonly Asked Questions

Typically up to 35 business days – as mandated by the Corporations Act. That is just 7 weeks!

Once a plan is put to creditors, they may vote to accept or reject the plan. They have 15 business days to vote to accept or reject the plan. The restructuring practitioner oversees the voting process and 51% of creditors (based on the amount owed) must agree for the structure to be approved.

Commencement of the restructuring process means affected creditors cannot continue or commence court or other recovery action against the company.

Commonly Asked Questions

Typically up to 35 business days – as mandated by the Corporations Act. That is just 7 weeks!

Once a plan is put to creditors, they may vote to accept or reject the plan. They have 15 business days to vote to accept or reject the plan. The restructuring practitioner oversees the voting process and 51% of creditors (based on the amount owed) must agree for the structure to be approved.

Commencement of the restructuring process means affected creditors cannot continue or commence court or other recovery action against the company.

Small Business Restructuring Specialists

Liability limited by a scheme approved under Professional Standards Legislation.

Small Business Restructuring Specialists

© 2024 SBRS. All rights reserved.

Small Business Restructuring Specialists

Liability limited by a scheme approved under Professional Standards Legislation.

Call for a confidential chat with one of our team.

Available Nationally

Small Business Restructuring Specialists

© 2024 SBRS. All rights reserved.